Simple Market Making

13th Dec 2024

The Bid Ask Spread

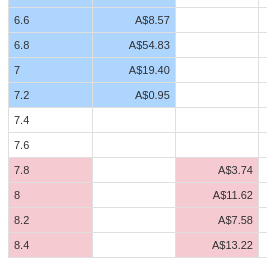

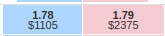

Following on from my previous article here, today I will explore in more depth the bid-ask spread. In my previous article I showed an example of the price ladder on betfair, and mentioned that the sell (ask) price being higher than and not equal to the buy (bid) price is quite consequential. Today we will learn why. Take another example of the price ladder, again on the betfair market:

As you can see, the best offered buy price is and the best offered sell price is . The difference between these two prices, is called the bid-ask spread. It can be measured in absolute terms, or in ticks.

What Is A Tick?

A tick is the finest level of price-increment available in a financial market. For different markets, there are different values, for example:

In a traditional market, it may be one cent. In a betting market it can actually vary, and in this case it's . In a cryptocurrency market, it can be a small fraction of a bitcoin for example.

Going back to our example above, we calculate the spread below in absolute terms, and ticks:

Since the tick size is in this case, it's

In this case, I have subtracted the opposing price itself as to not include it in the calculation.

Profiting From The Bid Ask Spread

Imagine a market where the prices never fluctuate, and the buy (bid) price is set at $100 and the sell (ask) price is set at $101. If you buy at $100 and sell at $101, then you're left with $1, nice. That's quite a small profit despite the $100 of your own money you had to risk to make that trade, but you still made money.

Buy why, you might ask, don't these two parties cut out the middle man (you) and make a trade directly with each other? In that case they could split the difference and choose the price $100.5, in this case, they both get a better price.

The seller who you would have otherwise bought off will sell at a 50c higher price, and the buyer will buy at a 50c lower price, in this case both parties win, but you don't get any money.

If this were to happen, a trade would be made at $100.5, but then a spread would be created again as all buy orders larger than or equal to the ask price or sell orders less than or equal to the bid price would result in a trade being made.

In financial markets, there will always be spread larger than zero, which opens up an opportunity to profit off it, which sounds simple, but it is not...

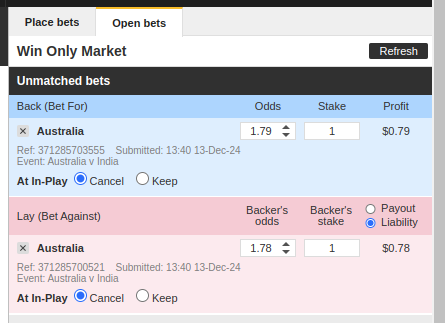

Naive Market Making

Assuming the prices will bounce up and down within some range, we can naively market make by just placing orders at the current price and hoping they will get filled in the next amount of time. The trick is to place orders at the best offered prices, that is, a buy order at the current sell price and a sell order at the current buy price.

As you can see, if both of these orders get filled, we will make a small profit of 1 cent, nice!

There are two problems with this:

- Our order is at the back of the queue, this means we need to wait until everyone else in front of us has had their orders matched, which may take an indefinite amount of time.

- If the prices change rapidly, one side of our trade will be matched, and the other side will not be, meaning we either need to wait for the prices to come back, and our order to be matched (there's no guarantee of that happening) or we need to cash out for a small loss and repeat the process in hopes that this time we will make a profit.

Therefore, we want to be able to profit from the bid ask spread no matter where the prices go whether it be up, or down.

This links nicely into our first article here, which explains how we wish to trade under the assumption that the movements in the stock market are completely random.

Thanks for reading my explaination of market making, be sure to tune in next time where I explore more strategies in greater detail.